One of the most important things that a business can do is actually verify that the money deposited in their bank matches to what the system reports. This article reviews the ins-and-outs of Reconciliation in netPark; verifying the amounts deposited to your bank, matching those numbers to the numbers netPark reports, and what kind of monthly summary reports are available.

netPark Pay Reconciliation Report

The best place to start when discussing funding and reconciliation is the netPark Pay Reconciliation Report. This report is available for all locations and is typically located under the Accounting section. This is the de facto report to run for reconciliation, as it will automatically compare the payments in the deposit against the payments reported by netPark and shows if there are any differences between the two as well as provides a full detail break out of all of the payments associated with a deposit.

The report can be run to split out chargebacks from the individual funding details to their own sections as well as adding a section to show unfunded payments that are included in the date range.

Report Overview

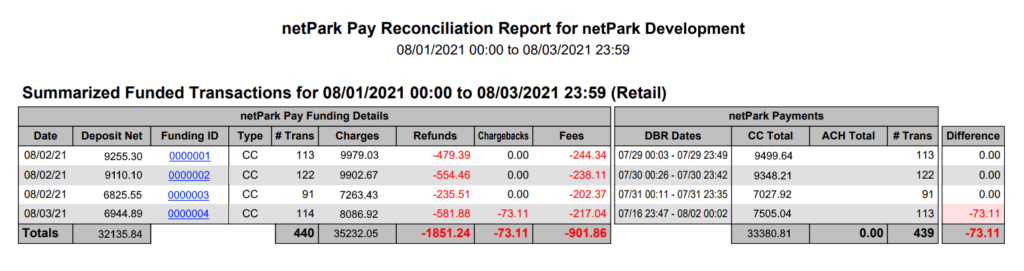

The general layout of the report is pretty standard for a netPark report.

On the left side we have the Date of the Funding, the Deposited amount and the ID of the Funding record. Next are the funding details – the amount of transactions, total credit card charge amounts, refunds, chargebacks and fees. The Deposit Net is calculated by taking the Charges, minus the refunds, chargebacks and fees.

On the right side are the netPark payments. These are the payments recorded by the system and not by the processor. The CC Total should equal the Funding Charges minus the refunds. Chargebacks will always be a “Difference”. When the report is run with Details enabled, an additional column, “DBR Dates” appears. If the Daily Business Report is run for these dates the report should match to the reconciliation. This is important later.

Click on a Funding ID jumps to a Details breakout for that funding record. These breakouts show every transaction funded and the details related to it.

Reconciling with netPark Business Reports

The netPark Reconciliation Report is designed to do this automatically. However, there may be reasons where it is useful to do this process manually. There are a few important items to note when trying to reconcile manually:

- Batch settlement does not always occur at the exact times chosen. For example, if you have your batch set to settle at midnight, there may be nights where it does not settle right at midnight, but 5-10 minutes (or potentially more!) afterwards. The reconciliation report automatically reports these.

- When running the Daily Business Report, run it for the same date & time range specified in the Reconciliation report’s “DBR Dates” to get a 1-to-1 match (note that chargebacks can affect this date range, it may be necessary to review the details to find the correct start date).

- If running the Daily Business Report for a different time than the ranges specified in the, please be aware that the total credit card amount may be different than what the funding report shows due to when the batch actually runs. This difference, when tracked over time, should net to $0.

- The Deposit Date is not the Charge Date on the Reconciliation Report. Review the DBR Dates column to see the date of the charges.

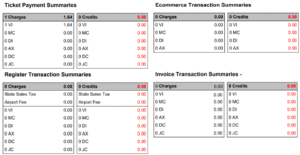

It works best to sum up the charges and sum up the credits individually. These should match the “netPark Pay Funding Details” “Charges” and “Refunds” columns on the Reconciliation report, assuming that the funding aligns to the dates chosen for the DBR.

Monthly Summary Reports

The netPark Pay Merchant Portal provides a monthly summary report, titled “Merchant Statement”, which provides a nice overview of the entire month with the following breakdowns:

- Summary by Charge Date

- Summary by Card Type

- Summary by Deposit Date